Surcharge costs and surcharge types

In FACTON, surcharge costs can be attached to cost elements. The calculation of these surcharge costs is based on surcharge rates.

You can choose between the following types of surcharge rates or surcharge rate groups:

| Surcharge rates | Surcharge rate groups |

|---|---|

Fixed sum per unit

This is an absolute surcharge. A fixed sum is added to the cost element. This type of surcharge affects both levels of calculation.

A fixed sum can be surcharged ("Surcharge on") on the following cost elements:

|

|

|

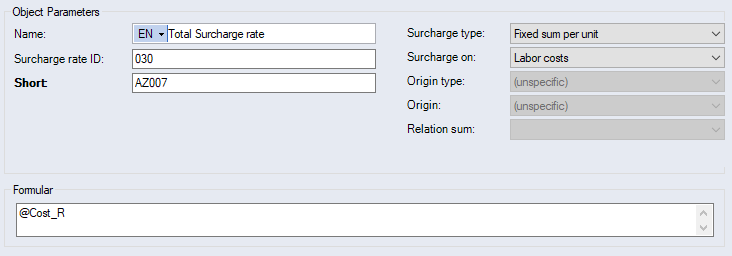

Formula entry option 1:

In this option, the absolute surcharge is derived from an attribute of the item being calculated. Thus, the character "@" is entered into the formula field together with the attribute name.

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Fixed sum per unit" type (Formula Example 1)

This requires that the attribute be a "floating-point number", and that it contain the value of the surcharge for 1 unit.

If the value of the surcharge rate is set in the Production Planning, then this value has priority over the attribute value.

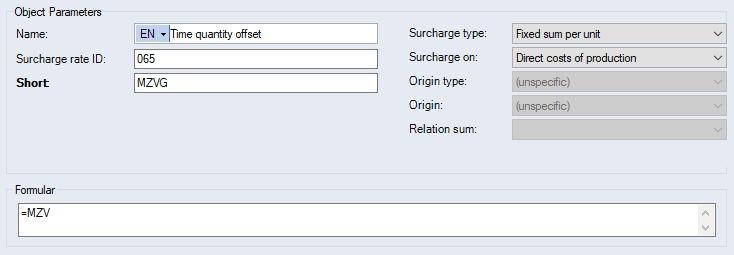

Formula entry option 2:

This option allows a fixed amount per unit to be defined for a cost element for a part or a product by entering the abbreviation for the costs or for the surcharge rate into the formula. The abbreviation must be preceded by "=".

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Fixed sum per unit" type (Formula Example 2)

In this example, a fixed sum equal to MSR is added to the manufacturing costs. It is possible to enter a formula of greater complexity, involving multiple surcharge rates.

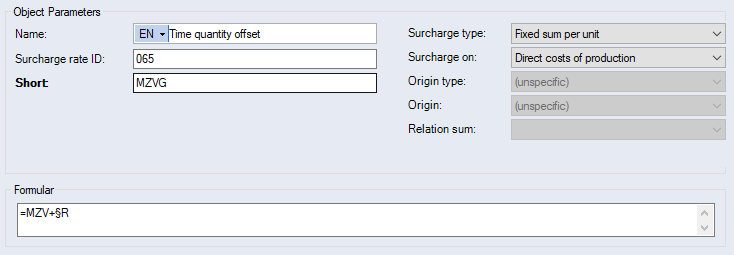

Formula entry option 3:

If the character "§" precedes the name of a surcharge rate in the formula, this formula will not use the calculated value of the surcharge but the value defined in the production planning. In case of surcharge rates for overheads, for example, the percentage value from Production Planning is used instead of the costs.

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Fixed sum per unit" type (Formula Example 3)

The example shows how a surcharge rate or costs are multiplied by the value of a surcharge rate from production planning.

Percentage

This is a surcharge in the form of a percentage. A percentage is added to the relevant calculation element.

A percentage can be surcharged ("Surcharge on") on the following cost elements:

|

|

|

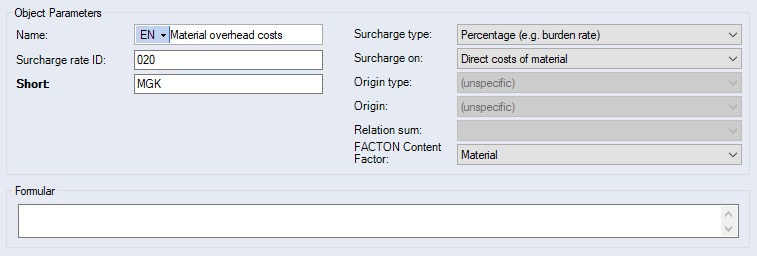

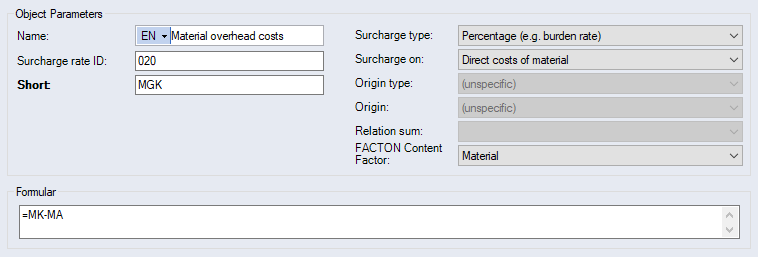

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Percentage" type

Some typical examples are:

- Material overhead costs with a surcharge on direct material costs.

- Manufacturing overhead costs with a surcharge on direct manufacturing costs.

- Even finer differentiated surcharges can be made on labor costs and machine costs.

Formula entry:

For a surcharge in the form of a percentage, the "Formula" entry field must be completed with the abbreviation for a different surcharge or total line. The surcharge is then added to the costs of this element.

At the component level, the formula can be used to define a different basis for surcharges. This can be achieved by using the "=" character and the desired abbreviation of the surcharge rate.

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Percentage rate" type (Formula example)

Using this formula will cause the material waste (MA) to be deducted before total material costs (MatC) are used as basis.

At the project level, only the surcharge type "Total line product" can be added. To do this, the entry "Cost definition" must be selected in the "Surcharge on" combobox, and the abbreviation of the desired surcharge rate with "Total line product" of the "Type" combobox must be entered in the "Formula" entry field.

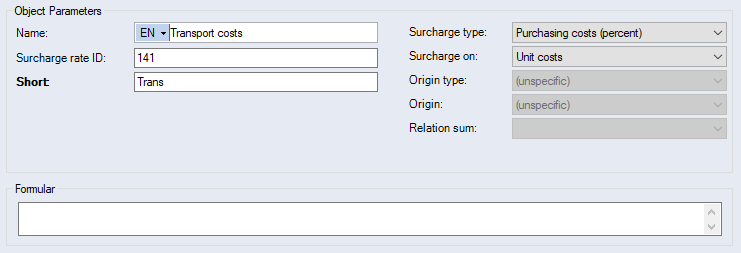

Purchasing costs

This is a surcharge in the form of a percentage which can only be charged to the unit costs. Unlike other surcharges in the form of a percentage, the calculated amount for the surcharge is not taken into consideration for the calculation at the current level but only at the next-higher level (parent element).

A percentage on purchasing costs can be surcharged ("Surcharge on") on the following cost elements:

|

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Purchasing costs (percent)" type

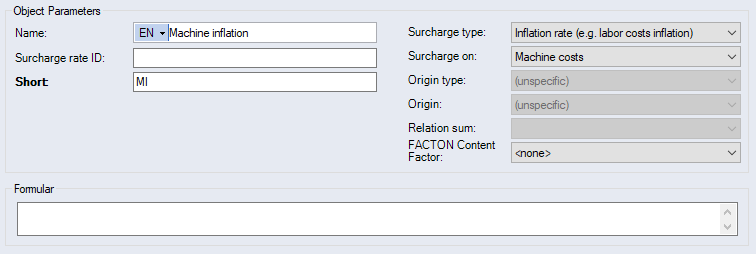

Inflation rate

The term inflation is used to describe a situation in the economy where the prices in general go up and goods and services measured in the given monetary units therefore become more expensive. The result is an increase in the price index, or a weakening of a currency's buying power.

The inflation rate is applied as a percentage in the form of a surcharge on the relevant cost element of a part and it is calculated across the calculation years of a project. The cost element is set in the "Surcharge on" combobox.

An inflation rate can be surcharged ("Surcharge on") on the following cost elements:

|

|

|

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Inflation rate" type

Exceptions to this are purchased/standard parts with automatic price search, and the operations in the Cost Center calculation mode. If the costs for a year have been stored, then those values will be used instead of the inflation values.

A project is calculated for the years 2001, 2002 and 2003, using the basis data type "case 1 (best)".

In the basis data type, an inflation rate was defined for labor costs, machine costs, material costs and purchased/standard part prices for each of the years.

The inflation per cost element for 2003 is the sum of the inflation of the preceding years.

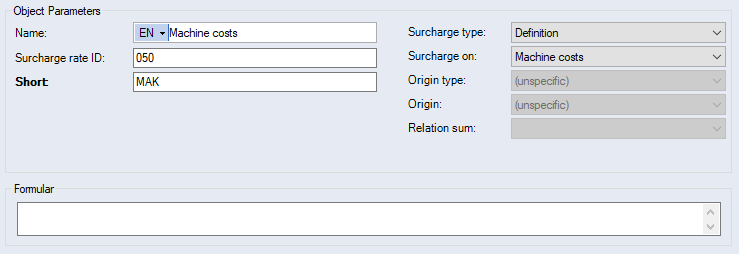

Definition

This makes it possible to apply cost components to surcharge rates in the calculation and to give them a name in order to use them in the remainder of the calculation, for example. These surcharge rates are totaled at the product level and permit a detailed analysis of cost components.

A manually defined surcharge rate can be surcharged ("Surcharge on") on the following cost elements:

|

|

|

A surcharge rate is created with the name "machine costs", the type "Definition" and the surcharge is placed on "machine costs". The abbreviation entered is “MachC”. From now on, all machine costs incurred in the project can be added to this surcharge rate and can then be reported.

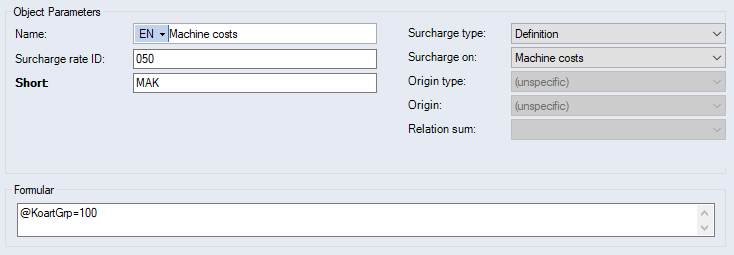

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Definition" type

An even more differentiated definition can be created using attributes. The display of the definition depends on the attribute value of a part.

Formula entry option 1:

An expression allows an attribute name preceded by "@" to be compared with a desired value.

Operations have a standard attribute of "KoartGrup" of type "integer".

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Definition" type (Formula example 1)

The calculation of the definition is performed for operations whose attribute has a value of 100.

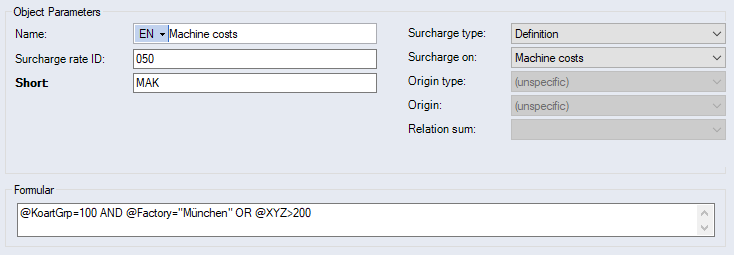

Formula entry option 2:

The formula consists of one or more Boolean expressions which can be linked using "AND", "OR" and "XOR", as well as "NOT". The expressions can be nested inside parentheses. If the entire expression is true, the definition line is accepted; otherwise it will be ignored. Similarly, if an error exists in the formula, the expression will be ignored.

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Definition" type (Formula example 2)

In addition to the standard attribute in example 1, operations also have the standard attributes "Plant" of type "text" and "XYZ" of type "integer".

The calculation of the definition is performed for operations whose attribute "KoartGrup" has a value of 100 and the attribute "Plant" has the value "Munich". Or, if the value of the attribute "XYZ" is greater than 200.

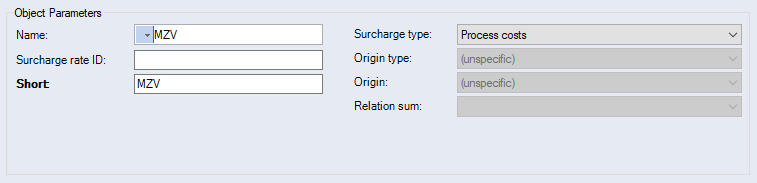

Process costs

This type is used in connection with the Calculation of process costs per quantity unit.

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Process costs" type

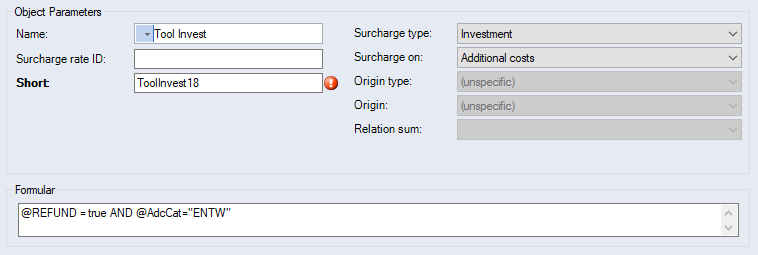

Investment

You can define investments in the "Investment" surcharge type.

A surcharge rate can be surcharged ("Surcharge on") on the following cost elements:

|

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Investment" type

Reimbursement/Refund

Reimbursements in FACTON are defined as refund cash outs that can be calculated by the external rate of additional costs. Reimbursements can also be considered as "negative" cash out.

You can define reimbursements and refunds in the "Reimbursement/Refund" surcharge type.

A surcharge rate can be surcharged ("Surcharge on") on the following cost elements:

|

You aggregate reimbursements via surcharge rate groups. To do this, use the "Total line product" type.

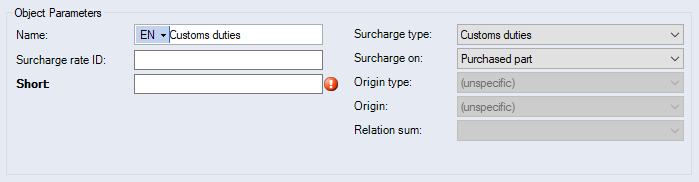

Customs duties

Customs duties can be surcharged ("Surcharge on") via a formula on the following cost elements:

|

|

|

Figure: Data Administration dialog, Basic data ► Surcharge rate, "Customs duties" type

The custom duty surcharge can also be used in other formulas. The calculated custom duty costs are shown at the purchased and standard parts, as well as at the inserted project.

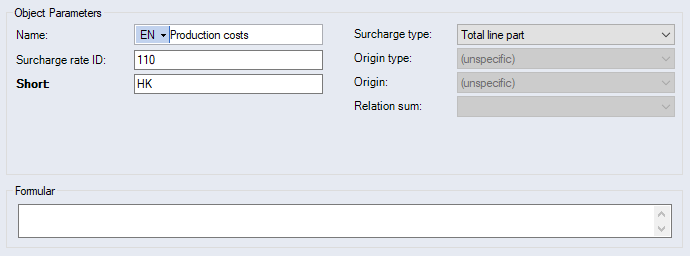

Total line part

This type is only available for surcharge groups. It allows total lines to be created for a part, e.g.: of surcharges that belong together. All elements below this group are added. If a formula is provided it will be used to calculate the costs.

Figure: Data Administration dialog, Basic data ► Surcharge rate group, "Total line part" type

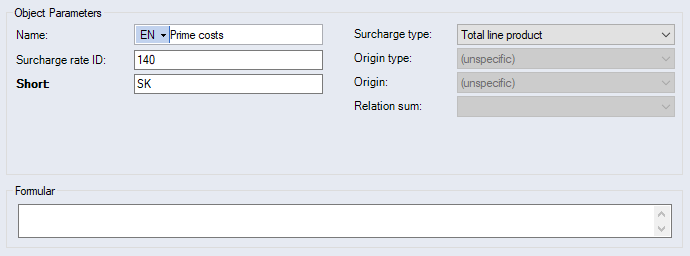

Total line product

This type is only available for surcharge groups and allows totals to be calculated in the extra charges. Either all the elements under this group are added or the total is provided via the formula.

Figure: Data Administration dialog, Basic data ► Surcharge rate group, "Total line product" type

The "Surcharge rate ID" is required if the total line is to be added to the product.

Formula entry

The names "WGBK" and "GZK" are abbreviations of other surcharge rates. Only the formula is used, and any other surcharge rates in the group are ignored.

"In hundred" checkbox:

When this checkbox is activated, the basis of the surcharge is not 100 %, but 100 % minus the sum of all percentage rates of all added surcharge rates.

"Cash sales price" total line; "In hundred" checkbox is activated.

Two surcharges are on this: 2 % customer discount, and 3 % sales commission

Thus, the surcharge basis is 100 % - 2 % - 3 % = 95 %

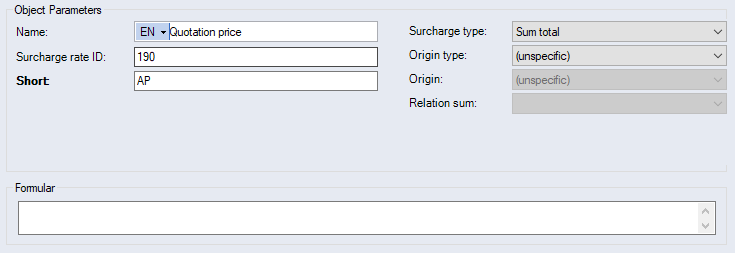

Sum total

FACTON requires this type in order to determine which costs should be displayed for the project. It represents the top-level element in the costing scheme. A formula can be entered for this type that defines the default totaling of all sub-elements.

An origin type can be assigned to a total sum. So the entire subordinate structure is specified for this origin type. You can choose between the following origin types:

- (unspecific)

- Suppliers

- Locations

- Customers

Figure: Data Administration dialog, Basic data ► Surcharge rate group, "Sum total" type

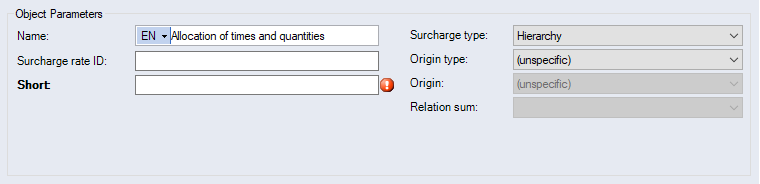

Hierarchy

This type has no effect on costs. It is merely used to structure the master data groups. You can use this type in order to structure the surcharge rates.

An origin type can be assigned to a hierarchy. You can choose between the following origin types:

- (unspecific)

- Suppliers

- Locations

- Customers

Figure: Data Administration dialog, Basic data ► Surcharge rate group, "Hierarchy" type

Ratio

This type is used for grouping key figures. In the Cost Information window and in the Liststyle, key figures are displayed as percentages.

Relation sum

Arbitrary relation sums can be defined in any costing scheme. A relation sum associates the total of one costing scheme with the equivalent totals of other costing schemes. So the different costing schemes are comparable.

Relation sums enable you to compare projects with one another and define the Liststyle for costing types.