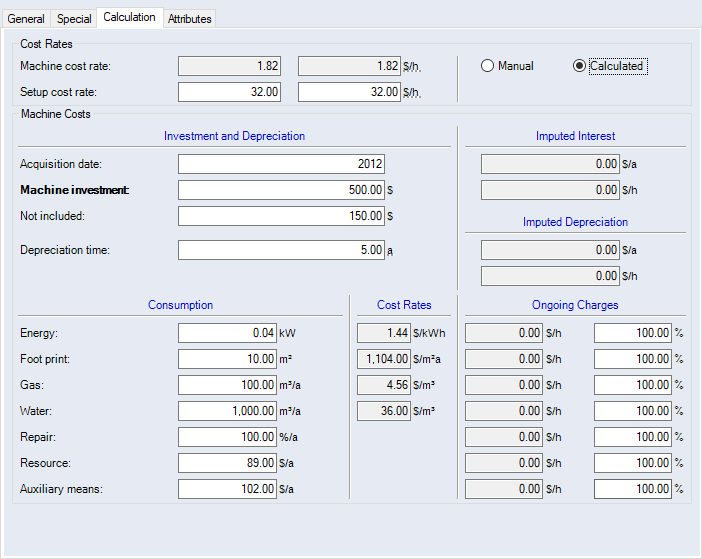

Calculation tab

The machine cost rates can be calculated or manually entered in the "Calculation" tab. Enter the calculation parameters for the machine costs.

If a cost center is assigned to the machine, the costs of the machine hour rate are calculated with the cost center. No additional costs can be defined.

Figure: "Data Administration" dialog, "Machines" category, "Calculation" tab

"Cost Rates" group

| Machine cost rate |

|

| Setup cost rate | Enter the overhead cost rate in the first, and the variable setup cost rate in the second entry field. |

"Machine Costs" group

| Investment and Depreciation | |

|---|---|

| Acquisition date | The year in which the machine was purchased. |

| Replacement costs | The machine's replacement costs. |

| Residual Value | Enter the residual value of a machine |

| Depreciation time | The number of years the depreciation takes place. |

| Imputed Interest |

|---|

| The fixed costs of the machine are calculated in this area. They are calculated as soon as all fields of the group are filled with values. |

|

|

The calculation is based on the interest rate for the linked location of the machine. If no location is linked, no calculation will be carried out and no interest will be charged. Machine costs can have an imputed interest component. Which means: If a machine was not acquired, this interest could have been generated. The interest costs are added to the costs of the machine. Imputed interest at the hourly cost rate of the machine can also be considered beyond the depreciation period. This option must be activated in the system settings, see Machine Depreciation and InterestThese settings are not active by default. By activating, depreciation and interest at the hourly cost rate of the machine are also considered beyond the depreciation period.When changing the validity context in the Data Administration of the machine, the values for the imputed depreciation and imputed interest remain.. |

| Imputed depreciation |

|---|

| The fixed costs of the machine are calculated in this area. They are calculated as soon as all fields of the group are filled with values. |

|

|

The linear imputed depreciation from the replacement costs is calculated without the unallocated share over the indicated years. The costs are calculated for the years of depreciation from the year of acquisition. Imputed depreciation at the hourly cost rate of the machine can also be considered beyond the depreciation period. This option must be activated in the system settings, see Machine Depreciation and InterestThese settings are not active by default. By activating, depreciation and interest at the hourly cost rate of the machine are also considered beyond the depreciation period.When changing the validity context in the Data Administration of the machine, the values for the imputed depreciation and imputed interest remain.. |

| Demand / Consumption | Cost rate | |

|---|---|---|

| Energy | The energy required for the machine. | calculated |

| Footprint | The footprint required for the machine. | calculated |

| Gas | The gas consumption per year. | calculated |

| Water | The water consumption per year. | calculated |

| Repair | The share of investment costs required for repairs. | |

| Resource | The costs of resources per year required for operating the machine. | |

| Auxiliary means | The costs of auxiliary materials per year required for operating the machine. | |

The calculation parameter of the cost rate are taken from the assigned location for the machine.

FACTON takes the SOP year into account when determining the location tariffs.

| Ongoing Charges | |

|---|---|

| First column | Shows the calculated running charges according to the demand and consumption parameters, as well as the location cost rates [in <currency> per hour] |

| Second column | Enter the variable share of the running charges of the respective demand and consumption parameters [in %] |