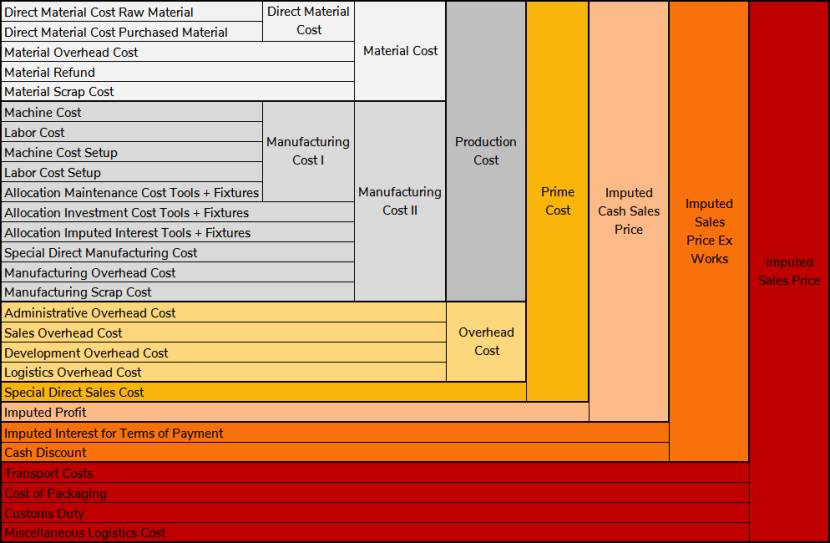

Costing Scheme

FACTON Should Costing distinguishes between two basic cost types. On the one hand, costs that can be directly assigned to a project element (direct costs) and, on the other, costs that are incurred during production but are not directly tied to a product (overheads).

Further costs can be included in the calculation using additional cost definitions (total lines) on the basis of predefined cost types. These costs are calculated by means of additional total lines per part and/or per product. The total can be calculated either by adding the existing values or by entering a calculation formula. In addition, surcharge rates, such as overheads can be added to all cost elements. Additional overheads can also be defined for total lines.

The FACTON product costing scheme consolidates all of the cost types required in total to calculate the complete costing. Costs can be incurred in a project in numerous ways. The chart lists all of the costs that are predefined in FACTON:

The cost summary in the Details ► Cost Summary view and in the Key Figures view follows this costing scheme.

Note

You can choose the Methodology of your should cost calculation, which is used to determine the following overheads:

- Administration Overheads

- Sales Overheads

- Development Overheads

- Logistics Overheads

These overheads can be calculated based on the Production Costs or the Manufacturing Costs II.

The costing scheme using an example:

| Cost type | Sample value [in €] |

|---|---|

| Direct Material Cost Raw Material | 1.00 |

| Direct Material Cost Purchased Material | 1.00 |

| Direct material costs of external provisions | 1.00 |

| Direct Material Cost | 3.00 |

| Material Overhead Rate | 10% |

| Material Overhead Cost | 0.20 |

| Material Refund | -1.00 |

| Material Scrap Rate | 10% |

| Material Scrap Cost | 0.22 |

| Material Cost | 1.42 |

| Machine Cost | 1.00 |

| Labor Cost | 1.00 |

| Machine Cost Setup | 1.00 |

| Labor Cost Setup | 1.00 |

| Allocation Maintenance Cost Tools + Fixtures | 1.00 |

| Manufacturing Cost I | 5.00 |

| Allocation Investment Cost Tools + Fixtures | 1.00 |

| Allocation Imputed Interest Tools + Fixtures | 1.00 |

| Special Direct Manufacturing Cost | 1.00 |

| Manufacturing Overhead Cost Rate | 10% |

| Manufacturing Overhead Cost | 0.42 |

| Manufacturing Scrap Rate | 10% |

| Manufacturing Scrap Cost | 0.20 |

| Manufacturing Costs II | 8.62 |

| Production Costs | 10.04 |

| Administration Overhead Rate | 10% |

| Administration Overhead Cost* | 1.00 |

| Sales Overhead Rate | 10% |

| Sales Overhead Cost* | 1.00 |

| Development Cost Rate | 10% |

| Development Overhead Cost* | 1.00 |

| Logistics Overhead Rate | 10% |

| Logistics Overhead Cost* | 1.00 |

| Overhead Costs | 4.02 |

| Special Direct Costs Sales | 1.00 |

| Prime Costs | 15.06 |

| Imputed Interest Rate | 10% |

| Imputed Profit | 1.51 |

| Imputed Cash Sales Price | 16.56 |

| Imputed Interest for Terms of Payment | 1.00 |

| Cash Discount | 1.00 |

| Imputed Sales Price Ex Works | 18.56 |

| Transport Costs | 1.00 |

| Cost of Packaging | 0.50 |

| Customs Duty | 0.50 |

| Miscellaneous Logistics Cost | 1.00 |

| Imputed Sales Price | 21.56 |

| * Based on the Manufacturing costs It is also possible to calculate this based on the Manufacturing costs II. |

|