You need full access rights to the "Capital Efficiency Analysis" function to see the "Investments" category.

The Investments category allows you to distribute the project costs evenly across multiple project years or additional costs.

Open Investments Category

-

Open the Project Cockpit dialog.

Open the Project Cockpit dialog.

- Open a project.

- In the ribbon, click on File ► Project Cockpit

.

.

- Switch to the Investments category.

Settings

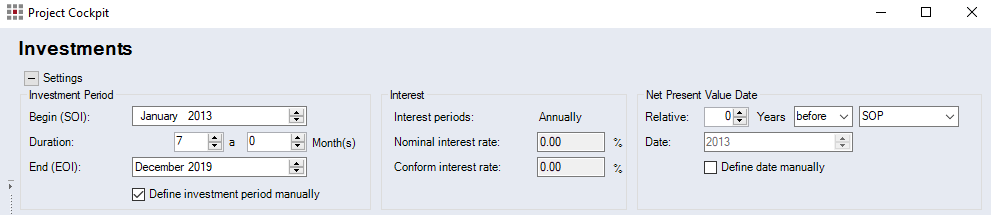

Figure: Investments Category, Settings

| "Investment Period" group | |

| Begin (SOI) | Enter the month and the year in which the investment begins. |

| Duration |

Enter the investment period in years (a) or months. The investment end date (EOI) is automatically set according to the entered duration. The application ensures that the investment period is longer or equal to the production period. |

| End (EOI) | Enter the month and year in which the calculation ends. |

| "Define investment period manually" checkbox | The checkbox is only available, if the system settings allow you to overwrite the investment period manually. |

| Interest group | |

| Interest periods | Display of the interest period in use. This is defined in the system settings and cannot be edited in the project. You can set monthly and annual interest periods. |

| Nominal interest rate | Corresponds to the annual interest rate on capital. The interest rate on capital is defined via an assigned location. |

| Conform interest rate |

The conform interest rate is imputed from the nominal interest rate for monthly interest periods. The interest for monthly interest payment with the conform interest rate correspond to the interests for annual interest payment with a nominal interest rate. |

| Net Present Value Date group | |

| Relative | The SOP and EOP, or SOI and EOI are displayed relative to the net present value date. This exact date can be defined in the system settings. |

| Date |

Shows the net present value date depending on the defined investment period of the system settings:

|

| "Define date manually" checkbox | The checkbox can only be activated, if the system settings allow you to define the date manually. |

Cash Flow tab

The Cashflow tab is not available for the Multi project ![]() .

.

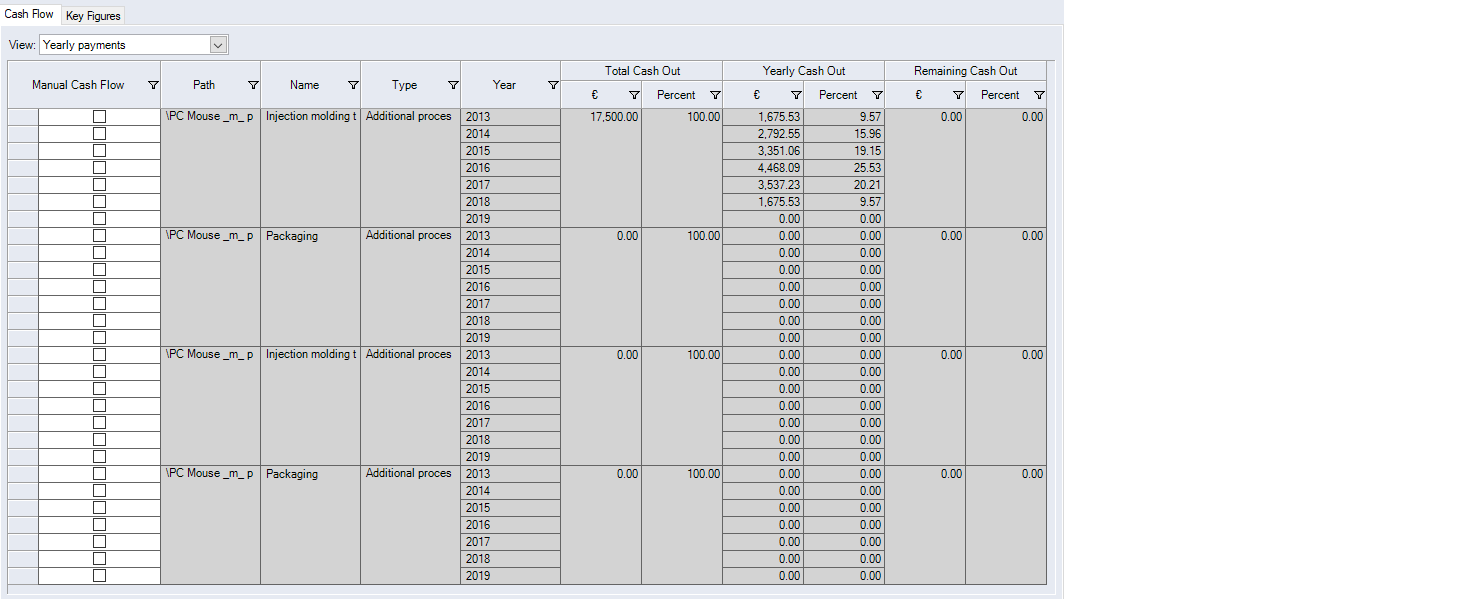

Figure: Investments Category, Cash Flow tab

| View combobox |

You can choose between 3 different views.

|

| Column Selection button |

You can hide or show additional values you have at least reading permission for. The column selection is user-specifically saved. The attributes are hidden by default; they can be displayed but not edited. |

| Manual Cash Flow checkbox | When activated, you can overwrite the monthly or annual payment. The checkbox is automatically activated for project-specific machines, or when you already have defined manual cash flow to an additional cost in the Insert Additional Costs dialog. |

| Path | Path of investment type in the project structure |

| Name | Name of investment type |

| Type |

Shows investment type

|

| Total CashOut | Sum of all payments |

| Remaining Cash-Out | Remaining payments to be disposed |

| Additional columns in the Annual payments and Monthly payments views | |

| Year | Year of payment |

| Annual Cash-Out | Payment distribution per year |

| Additional columns in the Monthly payments view | |

| Month | Investment month |

| Monthly Cash-Out | Payment distribution per month |

Key Figures tab

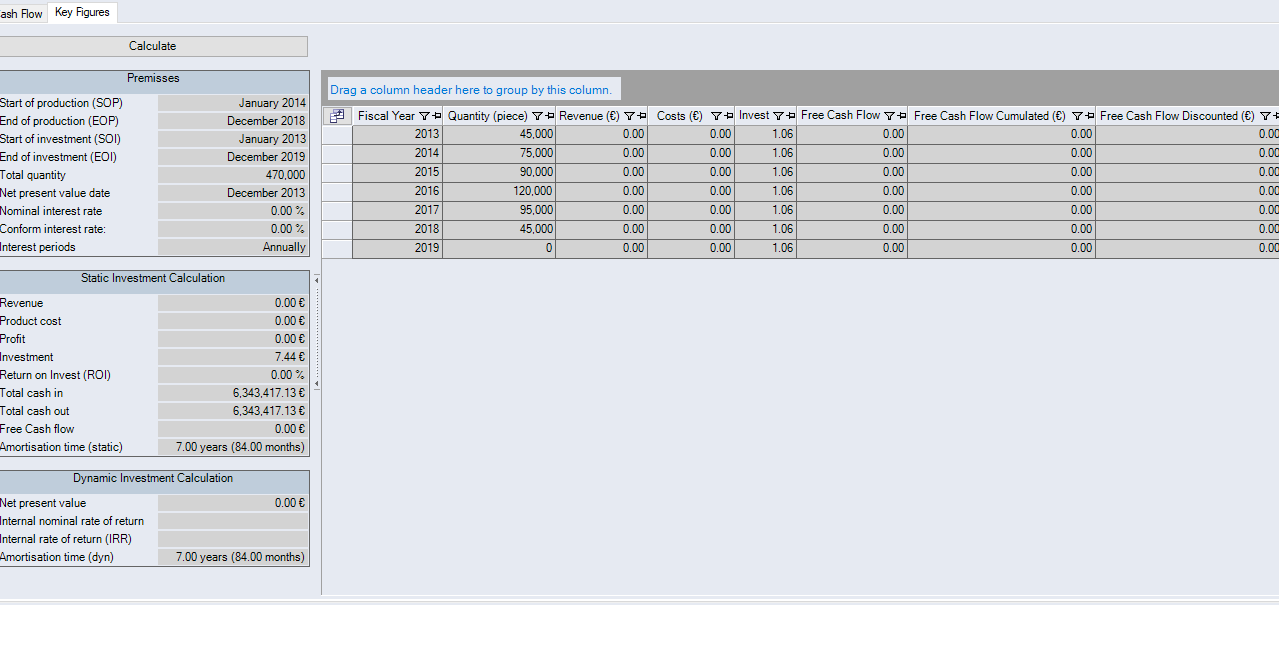

Figure: Investments Category, Key Figures tab

Static Investment Calculation

| Revenue | The revenue is determined by the monthly sales prices and is converted into the project currency. |

|

| Product costs | The product costs are determined by the monthly product costs, and are converted into the project currency. The monthly product costs are constant throughout the considered year |

|

| Profit | The profit equals the difference from revenues and costs. |

|

| Investments | Investments correspond to the sum of all defined disbursements of additional costs and machines throughout the project period. Investments are converted into the project currency |

|

| Direct payments (Refunds) | Refunds equal to the sum of all defined deposits of additional costs, and are converted into the project currency. |

|

| Total cash-in | Equals the sum of refunds and revenues. |

|

| Total cash-out | Equals the sum of investments and costs. |

|

| Return on Invest (ROI) | Equals the ratio from profit and investments in %. |

|

| Depreciation time (static) | Equals the average overplus amount of periods divided by the investments without considering the capital interest. |

with

|

The months from SOI to EOI are used for P.

A deprecation time less than 0 is not shown. A line is shown instead.

| I | Sum of all investment-affective disbursements |

| PUe | Average period overplus amount |

| U | Revenue over lifetime |

| E | Direct payments/Deposits |

| K | Product costs |

| P | Number of periods |

Dynamic Investment Calculation

| Capital value (Net present value) | The capital value is calculated based on the net present value and the period overplus amount which are discounted by the conform interest rate. No discount is made within the period that is directly defined by the net present value. |

| Internal nominal interest rate | The internal interest rate is that interest for which the capital value is 0. Monthly and annual interest periods are considered. |

| Depreciation time (dynamic) | Number of periods from SOI until the net present value reaches 0 or until the accumulated period overplus amounts switch from negative to positive. |