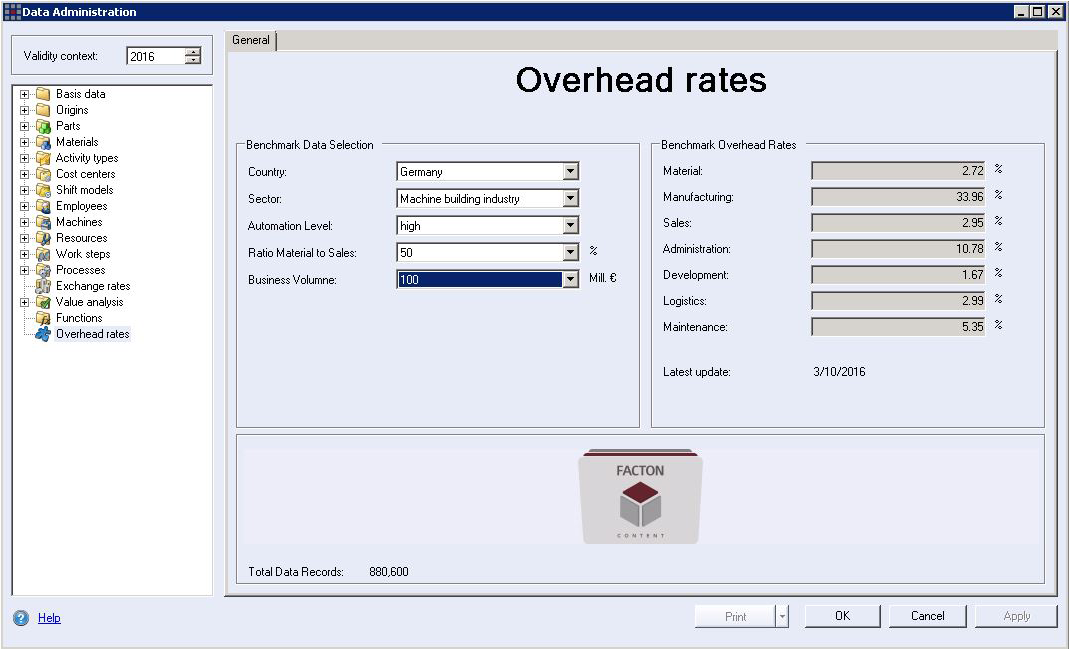

Overhead rates

The FACTON® Content overhead rates contain more than 500,000 benchmark data records for materials, manufacturing, sales, administration, development, logistics and maintenance. The data is maintained depending on the country, industry, level of automation in manufacturing, material percentage of the product price and the manufacturing location’s sales volume.

The sales volume refers to the manufacturing location; it does not correspond to the sales volume for the entire company or group of companies.

Figure: Administration - FACTON® Content - Overhead Cost Rate category

Composition of FACTON® Content - Overhead Cost Rate category

The table below details the information included in the individual overhead rates.

Table: Composition of FACTON® Content - Overhead Cost Rate category

| Overhead rate | Information included |

|---|---|

| Material overhead costs |

|

| Manufacturing overhead costs |

|

| Sales Overheads |

|

| Administration Overheads |

|

| Development Overheads |

|

| Logistics Overheads |

|

| Maintenance overhead costs |

|

All of these areas and functions are assigned personnel costs, employer personnel surcharge costs and material costs and their percentages are calculated based on sales volume. The following cost categories are allocated to material costs: vehicle fleet, services, rights, licenses, materials, setup, depreciation costs, energy costs.